This contribution is the final post in the four-part blog series on the history of mathematics in economics. For the first post on Philip Mirowski’s account of Irving Fisher, which also introduces the series, click here. For the second post on Marcel Boumans’s study of Jan Tinbergen, click here. For the third post on E. Roy Weintraub’s treatment of Gerard Debreu, click here.

The pieces of the previous weeks discussed different views on the relation between physics and the mathematization of economics. In order, they discussed Philip Mirowski’s thesis that neoclassical economics wrongly and inadequately applied physical theories to the economic domain; Marcel Bouman’s description of the way in which Jan Tinbergen applied physical instruments to economic problems when these problems were structured in the right way; and E. Roy Weintraub’s treatment of Debreu, for whom mathematics was important but any connection with physics was avoided. This final contribution will try to draw lessons from these historical accounts. But first, let us resume what these different historical stories have to say about the relation between physics and economics, the nature of mathematics and the mathematization of economics in general.

Epistemology: The Relation between Physics and Economics

The three accounts that have been covered describe three different attitudes that economists can have towards physics. The Fisher of Mirowski admires physics, and holds that the rigidity of the physical method would bring light to the cloudy discipline of economics. Fisher’s plea for the application of physical methods was justified by substantive analogies between the two sciences: that mathematical tools that were developed in physics were applicable in economics followed from the assumption that the subject matters of physics and economics were sufficiently similar. For Fisher, this meant that the use of mathematical tools that were derived from physics should be welcomed in economics; for Mirowski, this entailed a crucial mistake, not just because the substantive analogy was faulty, but also because the use of these mathematical tools in a different setting included unwanted semantic content from the original domain. Tools that are derived from physics will always, to some extent, refer to that physical domain, even when they are applied elsewhere. The next section will pursue this line of thought in some greater detail.

The Tinbergen of Boumans is also an admirer of physics, but in a more mitigated fashion. For Tinbergen, physics was instructive because it had inspired a mathematical language that could be useful to economics as well. Contrary to Mirowski’s Fisher, Boumans’ Tinbergen does not speculate about any substantive analogies between the respective subject matters of physics and economics. The only analogy between the two is that, under certain conditions, phenomena in both fields can be represented in the same mathematical form. Crucially, for Tinbergen, the mathematical language inspired by physics loses its link to its original discipline once it is applied to a new field; and so, unlike Mirowski’s Fisher, the mathematical language inspired by physics does no longer depend on physics once it is applied to economics. The correct use of dynamic relations only demands that the subject matter it is taken to describe conforms to the appropriate mathematical syntax.

The Debreu of Weintraub, finally, does not welcome physics transfer in economics. As we have seen, Debreu favored the pure mathematics of Bourbaki over the applied mathematics that is embraced by the other two accounts. According to Debreu, his Walrasian competitive equilibrium models capture something essential about economic systems. Turning to physics would only lead us astray. The kind of mathematics used by physicists had to be complemented by ‘bold conjectures and experimental refutations’ of a sort that was not available to the economist. This meant that physical analogies would not be useful to economists. The kind of mathematics that Debreu introduced into economics did, in other words, not depend on a substantive or formal analogy with physics.

In a way, Debreu inverted the relation between mathematics and economics. For both Mirowski’s Fisher and Boumans’ Tinbergen, mathematics was a tool to approximate relations that existed in the physical world, whether they are physical or economical. For Debreu, relations existing in the physical world are instances of pure mathematics.

Ontology: the Nature of Mathematics in Economics

Three different views on the nature of mathematics in economics seem to underlie these three different attitudes towards physics. This point has already been made for Debreu, and need not be repeated extensively here: his equilibrium models, built on pure mathematics, could capture something essential and unchanging about economic systems. Mathematics, in other words, captured something about reality.

The cases of Mirowski’s Fisher and Boumans’ Tinbergen are more complicated. For Boumans’ Tinbergen, mathematics seems to be a neutral language. While remaining silent on the relation between mathematics and reality, it is clear that mathematics is taken to be unbiased: once we have represented a particular physical phenomenon in the language of mathematics, there is, in the mathematics itself, nothing that necessarily depends on that source. If two physical phenomena – say, a pendulum and an oscillating spring – match a particular set of conditions, both can be represented with the same kind of mathematics. The step from two systems within physics to two systems in different disciplines is not fundamentally different.

How different is the picture for Mirowski’s Fisher. It has already been addressed that Fisher’s approach to the use of physics in economics was inspired by his conviction that there was a substantive analogy; mathematics was, in a way, the middle man. It is perhaps more interesting, in this case, to turn to Mirowski’s opinion of the matter. In the final pages of his book, Mirowski distills three levels of criticism that run throughout his work (p. 398-399):

- Once economists had appropriated the physical metaphor of energy, some of the problems that they ran into could have been solved or at least understood better by looking at their counterparts in physics. Economists failed to do that.

- The arguments that neoclassical economists construed out of their use of the physical metaphor were, with hindsight, bad arguments that confused rather than convinced their opponents.

- An economic theory based on a physical metaphor cannot be independent of its physical origin.

The third point seems to contradict the view of mathematics that Boumans sees in Tinbergen. For Mirowski, introducing physical analogies in economics is never ‘theory-free’, as in Boumans’ description of Tinbergen. Underlying Fisher’s use of the energy metaphor in economics is, for example, still the presupposition that energy/utility is conserved and that we are concerned with a closed Hamiltonian system. Mathematics is not a neutral language, as it seems to be for Boumans’ Tinbergen, but a semantic system full of explicit and implicit meanings. Accordingly, the application of a kind of mathematics that originated in physics will always carry traces of its physical genesis.

This leads Mirowski to conclude that the blind application of physical metaphors in economics has left economists with mathematical models that were useful in the 19th century physics, but are devoid of meaning in economics.

The Mathematization of Economics

It has been emphasized before that, according to Mirowski, the mathematization of economics was built on the foundations of a physical metaphor. This physical metaphor was badly understood by economists and not applicable to the subject matter of economics; it derived its appeal mostly from optimistic attitudes towards physics and its ability to confuse opponents, rather than from its own success. The current mathematization of economics, according to Mirowski, is a development that was defended on false pretenses. Rejecting the physical metaphor of energy, as Mirowski believes we should, seems to imply the rejection of mathematical formalism in its current form.

It should be noted that while Mirowski sees the physical metaphor as a necessary condition for the current mathematization of economics, this does not imply that the mathematization of economics is necessarily an undesirable development. It seems in principle possible to have a mathematical economics that is not dependent on a physical metaphor; in fact, that is exactly the kind of economics that Debreu argues for.[1] Mirowski discards the mathematization of economics insofar as it derives from a faulty physics metaphor; he does not explicitly discard mathematization per se.

Debreu, of course, embraced the mathematization of economics, but only mathematization of the pure kind. We have seen that Debreu was unimpressed and even skeptical of the applied mathematics that introduced into economics from physics. By founding economics on Walrasian competitive equilibrium models, economists would have a stable research agenda that fitted better with the subject matter of the discipline.

Boumans’ Tinbergen in a way covers the middle ground. As Boumans construed it, Tinbergen turned to physics in order to solve very particular problems. On a more abstract level, this problem was the alleviation of poverty; on a more concrete level, the problems were his dissatisfaction with the static equilibria of Walras and Pareto and the state of business cycle research. The mathematization of economics was a means towards these ends; it was not an end in itself.

Elsewhere Boumans elaborates on this view on models (1999). He states that models are often rather simplistically depicted as mediators between theory and reality. Instead, he suggests that models are constructed by combining different ‘ingredients’ according to a particular ‘recipe’. These ingredients could be, for example, particular mathematical forms, specific phenomena that one wants to account for or theories that one wants to be consistent with. The selection of ingredients and the decision on how to combine them is guided by the purpose for which the model is constructed. In the case of Tinbergen, the introduction of dynamic models was one of the ingredients that Tinbergen introduced to solve the problems he was facing.

Conclusion: Lessons to Learn

The lessons that can be learned from these historical cases, and the way in which these historians described them, depend on the account that we deem applicable for the economics of today. All three accounts seem to be relevant in at least some respects, and give us different and important insights pertaining to current events. Mirowski criticizes the economic tools that are still a major part of the economic toolbox; Debreu’s emphasis on equilibria is still sweeping the field, albeit in somewhat modified form. Boumans description of Tinbergen is relevant not only because Tinbergen laid the foundations for the econometric method, but also because of his more general suggestion that mathematical tools are tools, constructed for the solution of particular problems (pace Debreu).

Lesson 1: The relevance and utility of mathematical tools for economics depends on its field and mode of application.

On a more general note, this means that it makes little sense to talk about ‘the mathematization of economics’. While Krugman seems to have a point when he talks about the distinction between mathematical beauty and truth, but the implications of the statement remains unclear unless it is qualified. More specifically, we risk throwing the baby with the bathwater if we do not acknowledge the different ways in which mathematics can be used in economics. The first lesson of this historical survey is, in other words, that the relevance and utility of mathematical tools for economics depends on its field and mode of application. Krugman was right to point out that mathematics is no panacea, but wrong if he is taken to suggest that it cannot help at all.

Lesson 2: Whenever we consider introducing mathematical forms from discipline A into discipline B, we should argue for its applicability.

One version of this lesson can be learned from both Mirowski and Boumans. Mirowski showed that the blind application of the physical metaphor of energy in Fisher’s economics created inconsistencies that have not been solved until today. Boumans’ Tinbergen, on the other hand, provided us with explicit conditions under which economics could make use of the mathematical forms he had taken from physics. Both Mirowski and Boumans emphasize the need to justify the use of mathematical models. In the case of Mirowski, the emphasis lies on semantic content that might seep into economics from physics when we draw on the energy metaphor for utility economics; in the case of Boumans, the emphasis lies on the mathematical conditions that economic systems must satisfy in order to be represented with dynamic functions.

Another version of this lesson can be drawn from Debreu. According to Debreu, the kind of mathematics used in physics worked there because it was complemented with ‘bold conjectures and experimental refutations’. Because economics was not organized in a similar way, the kind of mathematics that physics provided us with would not work in economics. We should not only pay attention to the applicability of a particular mathematical form within a subject matter of our theory, but also within its method.

Lesson 3: Mathematization is a way to transcend theory (Debreu), or it is not (Boumans).

In discussing Debreu, we noticed that the appeal of an economics inspired by Bourbaki was, in part, that it was taken to have the potential to unify competing theoretical schools. Mirowski, it has been noticed before, does not discuss pure mathematics. Boumans, on the other hand, would argue that the idea of a transcending mathematical theory of economics overlooks that models are built to solve particular problems. This instrumentalist attitude towards theories disagrees with Debreu’s insistence that equilibrium models capture something about the essence of economic phenomenon.

The previous posts in the series have aimed to uncover some of the complexity of the role that mathematics has played in economics, taking Krugman’s well-known concern as a starting point. While his warning against unquestioned faith in mathematics should in itself be taken to heart, it should not be replaced with unquestioned pessimism either. Whether the mathematization of economics is beneficial or merely a distraction depends, this series has hoped to show, on one’s view of the nature of mathematics, but also on the constraints that we impose upon its use. Questions regarding the nature of mathematics would involve continuing debates on, for example, whether mathematics is best described as a language or as a structural trait of reality. Questions regarding the constraints on its use are likely to be context dependent, as was suggested by Boumans. For a constructive debate on the role and possible dangers of the use of mathematics in economics, a further exploration of these difficult inquiries seems essential – not just out of academic curiosity, but also in order to improve our economic systems.

o-o-o

I am grateful to Ivan Flis for helpful suggestions and corrections in producing this blog series. The paper from which this series is derived was written under the supervision of professor Geoffrey Hodgson (University of Hertfordshire), and has benefited greatly from his commentary.

Manuel Buitenhuis is a graduate student at the University of Utrecht (MSc History and Philosophy of Science) and the Erasmus University Rotterdam (MA Philosophy and Economics). He holds a BA-degree from University College Utrecht, where he mainly studied economics and philosophy.

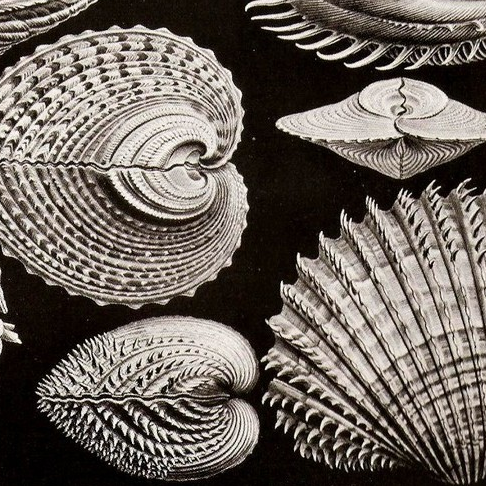

Image: http://www.freeimages.com/photo/1035681

Bibliography

Boumans, M. (1999). Built-in Justification. In M. Morgan, & M. Morrison, Models ad Mediators: Perspecitves on Natural and Social Science (pp. 66-96). Cambridge: Cambridge University Press.

Boumans, M. (1993). Paul Ehrenfest and Jan Tinbergen: A Case of Limited Physics Transfer. In N. de Marchi, Non-Natural Social Science: Reflecting on the Enterprise of More Heat than Light (pp. 131-156). Durham and London: Duke University PRess.

Krugman, P. (2009, September 2nd). www.nytimes.com. Retrieved June 8th, 2014, from The New York Times: http://www.nytimes.com/2009/09/06/magazine/06Economic-t.html?pagewanted=all&_r=0

Mirowski, P. (1989). More Heat than Light. Cambrdige: Cambridge University Press.

Weintraub, E. (2002). How Economics Became a Mathematical Science. Durham and London: Duke University Press.

[1] This, in turn, does not imply that Mirowski and Debreu are on the same page: Mirowski does not seem to be a big fan of Walras, on who Debreu draws extensively.